What is Automatic enrolment

What is Auto enrolment?

Under auto enrolment, every employer in the UK is legally required to set up a workplace pension, enrol all their qualifying employees and contribute to their pension savings.

The government introduced auto enrolment in 2012 to help more people save for their retirement. Since then around 10 million people have been auto enrolled and are saving for their retirement with their employer’s help.

Minimum pension contributions

The total minimum contribution rate is currently 8%.

This means that, as a minimum, your employee has to contribute 5% and you (the employer) must also contribute at least 3% of your employees qualifying earnings.

Qualifying earnings at a glance

Qualifying earnings are the total employee earnings between a lower and upper limit set by the government and reviewed each year.

For the 2021-2022 tax year:

- the lower limit is £6,240

- the upper limit is £50,270

- the maximum qualifying earnings is £44,030 (£50,270-£6,240)

Note: Not all auto-enrolment pensions are based upon qualifying earnings.

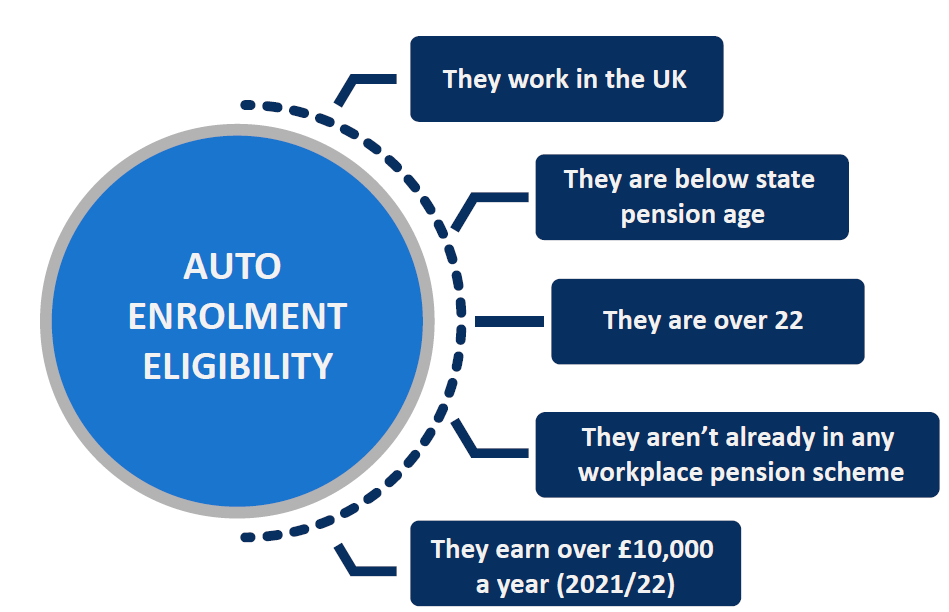

Who meets the criteria for Auto enrolment?

No matter whether you’re staff member is a full-time worker or a part-time worker, you need to enrol them in a workplace pension, if they meet the below criteria:

Do I have to set up a Pension scheme?

The short answer is YES - unless all of your staff fall outside of the age and earnings criteria, then you only need to put them into a pension scheme if they ask.

But…my employee doesn't want a pension, so why have I got to set up a scheme?

We get the frustration… but unfortunately even if your employee has confirmed they don't want to be a member of the scheme, the process of setting up a pension, enrolling your staff member and them ‘opting out’ still has to be followed for you to be compliant as an employer.

What happens if I don't comply?

If you don’t comply with your duties, The Pension Regulator may take enforcement action including compliance notices, and penalty notices (fines).

- If you repeatedly fail to meet your auto enrolment duties, you will have to pay escalating fines.

- If you still fail to comply after receiving multiple fines, you could face legal action.

- Eventually, you could receive a prison sentence of up to two years.

Need to find out more info? - here's our other Help pages regarding Auto enrolment

What is Postponement: Click here

How do you ‘Opt out’ of pension: Click here