COVID-19: Supporting YOU and your business

We understand that many business owners are struggling to understand the set of measures introduced by the government to support businesses through this period of disruption caused by COVID-19.

We have created this dedicated page to help you understand the support in place and how to get to it.

The aim here is to provide you with some easy to understand guidance, covering off the main topics relating to payroll matters:

- Coronavirus Job Retention Scheme

- Coronavirus Job Retention Scheme – does this cover Directors?

- Sickness/self Isolation absence due to COVID-19

- Contacting HMRC for ‘Time to Pay’ service

Watch this 2 minute video FIRST to understand why we have created this page for our clients

Hot Topic, lots of questions on these two topics…

Watch theses two videos with updates regarding:

The 80% Furloughed process – How we will be helping.

Directors being ‘Furloughed’

Click below to access the “Furlough” Variation Contract

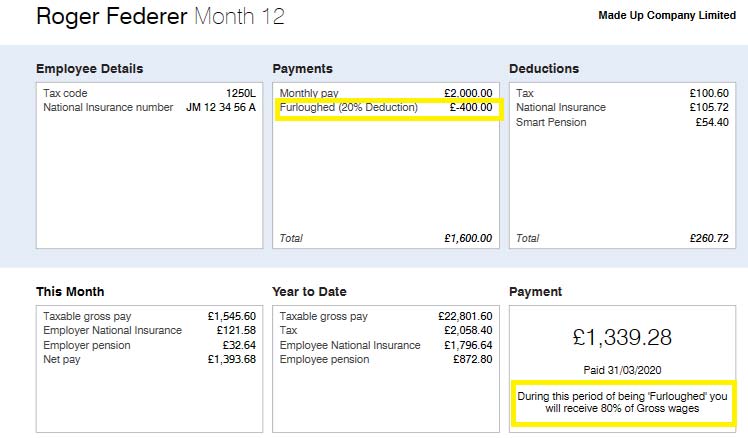

For Furloughed workers – this is what they will see on their payslip…. for now at least!

Government guidance on how to apply the Job Retention Scheme is yet to be provided (we are hoping it is coming soon!!), as a result, for clients that need payroll processed before further information is released, we will proceed with processing 80% of Gross Pay.

For those employees that have been furloughed, we have shown here an example payslip highlighting how the 80% furloughed will be shown on the payslip for clarity.

As usual there are lots of individual scenario’s that we cannot cover off all at once, but the idea of this is to give you a heads up before any of you/your employees receive payslips where the scheme has been applied and staff have been furloughed as per your instruction to us.

It’s our understanding that deductions for Tax , National Insurance and pension etc. will be applicable in the normal way. However, until further information is provided we cannot be 100% sure this is how they plan to apply the scheme – we have been forced to make an ‘educated’ assumption.

As a result of the lack of information and clarity from Government at this stage, we are taking the decision to withhold the RTI submissions to HMRC in the hope that information will be released and we can look to adjust our approach if required.

We haven’t got all the answers…

There’s plenty of documentation out there, but it doesn’t cover some basic fundamental questions. I understand there are lots of us out there, including us at Payroll Sorted (along with the rest of the payroll/accounting world) who have questions to which the answers just aren’t yet available.

Our aim is to communicate new information and cover off questions as quickly as we can.

WARNING – PLEASE DON’T ASK US THIS

➙Coronavirus Job Retention Scheme

Update: 27th March 2020

Updated guidance was published last night that answers some, but not all, of the many questions around how the scheme will operate. The main details shown below, follow this link for full guidance:

This is something we will be applying and submitting on your behalf – the calculations will be driven by what we are processing through the payroll. Rest assured, we will be able to apply for the grants for you.

- The scheme covers 80% of the employees “usual” monthly wage costs (does not include fees, commissions or bonuses), up to £2,500 plus Employer National Insurance contributions and minimum automatic enrolment pension contributions on the gross salary funded by the grant.

- The minimum period an employee can be furloughed for is 3 weeks

- For employees whose wages vary and they have been employed for 12 months prior to the claim, you can claim the higher of:

- The same month’s earning from the previous year

- Average monthly earnings from the 2019-20 tax year

- Nothing in the current publications specifically excludes directors however, as explained in our previous communication, work cannot be carried out whilst an employee is furloughed, this may be challenging to achieve/demonstrate in a Company where there is a single director.

- Employers must write to the employee confirming they are being furloughed, and keep a record of this.

- Normal rules apply regarding SMP but if you make enhanced payments, they qualify as wage costs under the scheme.

- Where employers receive public funding for staff costs, and that funding is continuing, the expectation is that employers will use that money to continue to pay staff in the usual fashion – and therefore, not furlough them. This also applies to non-public sector employers who receive public funding for staff costs. It is unclear at this stage if this is also referring to apprentices.

On Friday 20th March-20, the government announced an emergency coronavirus grant to cover employee wages.

Details of how to claim the grant are yet to be released, but the government wants all affected businesses to be able to access it. This financial protection from the government is welcome and they have promised that; “Any employer in the country – small or large, charitable or non-profit – will be eligible for the scheme”.

HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month – WATCH the videos below for more information:

Coronavirus SSP relief package

The Chancellor also announced ‘Budget Day’ Support for businesses who are paying sick pay to employees.

SSP start date

SSP to be paid from day 1, rather than day 4, of your employees absence from work, if they are absent from work due to sickness or need to stay at home due to COVID-19. Once the legislation has been passed, this will apply retrospectively from 13 March-20.

The Facts:

– Employers will be refunded to cover up to 2 weeks’ SSP per eligible employee who has been off work because of COVID-19.

– Eligible for Employers with less than 250 employees as of 28 February 2020.

The Government still haven’t confirmed the way in which the repayment to Employers will happen or when… once information is released these pages will be updated.

Proof of sickness

You need to keep us informed as normal for any employees that become sick or have to self isolate, so that we can maintain records of staff absences and payments of SSP.

If your employees have COVID-19 or are advised to stay at home, please request they get an ‘isolation note’ by visiting NHS 111 online, rather than visiting a doctor. For COVID-19 cases this replaces the usual need to provide a ‘fit note’ (sometimes called a ‘sick note’) after 7 days of sickness absence.

For those employees who live with someone that has symptoms, they can get a note from the NHS website.

Contact HMRC – Time to pay arrangements

HMRC have set up a dedicated helpline for businesses in financial distress – PAYE & CIS payments are being deferred and effectively ‘ring fenced’ for a 3 month period.

The helpline number is 0800 0159 559 – when calling, be sure to have your PAYE and Account Office reference to hand and be prepaired for a long wait.

Watch Ben’s video and hear his account of what happened when he called HMRC for our Business (Payroll Sorted) to request the ‘Time to pay’.