To email or not to email a payslip….

Now that’s a question we have been asked once or twice.

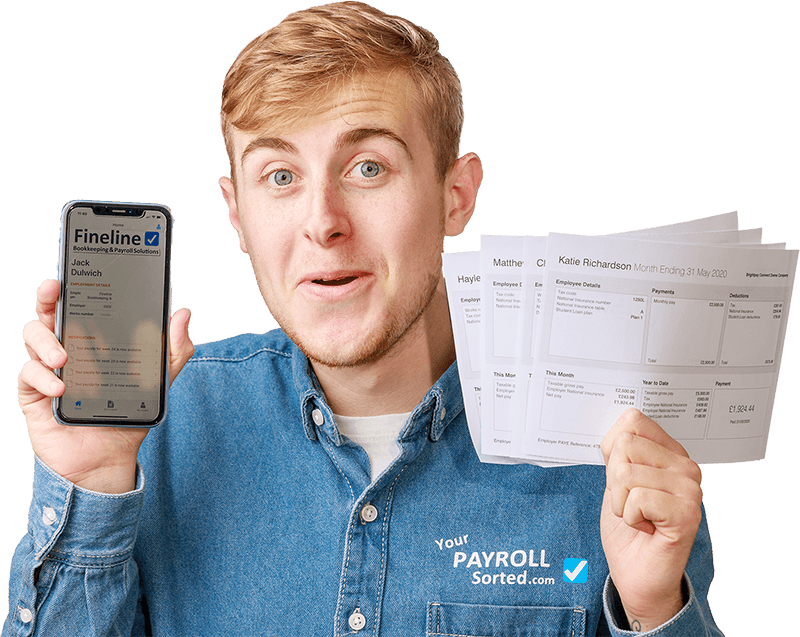

By law, employers must provide employees with payslips which include personal data such as proof of earnings, tax paid and any pension contributions.

But how should payslips be distributed to employees whilst making sure to stay GDPR Compliant ?

Historic Payroll Approach

Emailing Payslips

The good news is there is nothing in the GDPR legislation that states it is no longer permissible to email payslips.

However, as data processors, Payroll Sorted take additional steps to securely protect each employee’s payslip. When emailing payslips to your employees we ensure that all payslips are password protected with a password that is unique to each employee.

Payslips are sent directly to the employee’s chosen email address.

Furthermore, we also provide secure encryption on all payslips and automatically delete payslips that are being sent from within our payroll software provider’s server.

Posting Payslips – do people still do this? Surely not?

There is nothing in the GDPR legislation that states it is no longer permissible to post payslips – but things have moved on and the days of ripping open the tear away edges of the printed payslips have long gone!! Payroll data processors who post payslips need to ensure that all appropriate security measures are in place to protect the payslip – using security payslip envelopes, marking the envelope as ‘Private and Confidential’ and ensuring that it is addressed to a specific person. None of this is completely fool proof so its not a service that we tend to offer to our clients.

Our Approach – Embracing technology

For maximum security our recommended (but not mandatory) solution is to offer every client our secure Payslip Portal to securely send and store payslips and other sensitive payroll documents. Please view our Payroll Portal page for more info.